colorado estate tax form

If you have income from the exercise. DR 0461 - Monthly Return of Oil Gas Severance Withheld.

Free And Discounted Tax Preparation For Military Military Com

Colorado has 560 special sales tax jurisdictions with local sales taxes in.

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

. If you owe additional tax return the completed form and check payable to The City of Colorado Springs Sales Tax PO Box 1575 Mail Code 225 Colorado Springs CO 80901-1575. 1826-111 - 1125 Waivers Consent to Transfer. Real Estate Tax Certification Request Form.

If you would like to download or print a PDF version of a form click on the underlined form number below. Colorado taxpayers who remit federal estimated tax payments to the IRS with federal Form 1040-ES typically must pay estimated tax to the Colorado. New York estate taxes.

Total Colorado tax liability less withholding and credits exceeds 1000. The tax waiver form issued by the Division releases both the Inheritance Tax and the Estate Tax lien and permits the transfer of property for both Inheritance Tax and Estate Tax purposes. The exemption is equal to 50 of the first 200000 in home value.

No Estate Tax was imposed for decedents who died after January 1 2018. On the other hand homeowners in Colorado get a break on real estate taxes. The alternate valuation date can only be used if the brothers total estate is large enough to file an Estate return Form 706 and if the alternate valuation date will decrease.

So for example if a home is worth 100000 50000 of. Print complete and mail the Certification Request Payment Form with your payment. Groceries and prescription drugs are exempt from the Colorado sales tax.

Small estate While a small estate offers the simplest and cheapest form of probate only estates worth less than 50000 can claim. DR 1079 2021 2020 2019. The states property tax rates are among the nations lowest with an average effective rate of just 049.

In May of 2019 the General Assembly passed House Bill 19-1212 which concerned the recreation of the CAM licensing program. Oregon has an estate tax ranging from 10 to 16. Let Us Help You.

Real estate transfer taxes are an especially tricky issue in Colorado as the state passed a constitutional amendment in 1992 freezing all real estate transfer taxes and prohibiting any new. A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. If you are looking for prior-year forms or forms for a certain tax type visit the Forms by Tax Type page then select the type of tax for form you are seeking.

A Florida real estate power of attorney is only legally binding if it is signed in the presence of two 2 witnesses as well as a notary public. For full details refer to NJAC. If ownership is held in a life estate checking the life estate box will assist the assessors office in processing your application.

Find a Law Firm. Through its Member Clubs Toastmasters International helps individuals learn the art of communication including speaking listening and thinkingvital skills that promote self-actualization enhance. Community Association Manager licensing and regulation existed in the form of the Community Association Manager Program housed in the Division of Real Estate from July 1 2015 to July 1 2019.

Please allow 3-5 business days for a response. If you have overpaid your tax return the completed form along with any supporting documentation to The City of Colorado Springs Sales Tax PO Box 1575 Mail Code 225. Laws 709-22012b 5 Signing Requirements Notary Public and Two 2 Witnesses 709-2105.

Age occupancy and ownership - In order to use the Short Form all three questions in this. If you receive other information returns such as Form 1099-DIV or Form 1099-INT that report gross income to you rather than to the bankruptcy estate you must allocate that income. Where Leaders Are Made.

New York State Estate Tax Return Form ET-706. A quitclaim deed is not generally used in a traditional sale of real estate. DR 0084 - Substitute Colorado W2 Form.

The Colorado state sales tax rate is 29 and the average CO sales tax after local surtaxes is 744. When considering these local taxes the average Colorado sales tax rate is 772. Section 1 Toastmasters International is the leading movement devoted to making effective oral communication a worldwide reality.

O Life estate It is permissible for ownership to be held in a life estate. HAB-RET 50 N 7th Street Bangor PA 18013 and include the following. The 062 road repair maintenance and improvements tax will expire five years from the date of implementation and will apply to all transactions that are currently taxable under the City Sale sand Use Tax Code.

Your bankruptcy estate reports the wages and withheld income tax for the period after you filed for bankruptcy. Articles Organized by Areas of Law Find articles written by qualified lawyers. This page lists only the most recent version of a tax form.

But that there are still complicated tax matters you must handle once an individual passes away. In a divorce a quitclaim deed is a way to transfer ownership in property between divorcing spouses. It is most commonly used when ownership rights in a property are transferred among family members.

Colorado real estate transfer tax laws vary throughout the state so buyers should consult a local real estate professional for specific information. Does Colorado Have an Inheritance Tax or Estate Tax. However like so much in tax law the answer to this question is it depends.

The state has an exemption of 1 million in estate taxes. First Name Last Name Company Name Mailing. If you would like to have a real estate receipt mailed to you Please mail your request to.

Generally when you inherit money it is tax-free to you as a beneficiary. For other forms in the Form 706 series and for Forms 8892 and 8855 see the related instructions for due date information. C If notice is sent under Section 53057 the owner may withhold funds immediately on receipt of a copy of the claimants affidavit prepared in accordance with Sections 53052.

A Colorado tax power of attorney form allows a resident of Colorado to let another person usually an accountant or attorney handle his or her tax filing with the Colorado Department of Revenue. For example the spouses owned the marital home together. The senior property tax exemption is a form of property tax relief available to seniors who own and occupy their home in Colorado.

Estimated payments for an estate or trust with the EstateTrust Estimated Tax Payment Form 105EP. DR 0021W - Oil Gas Withholding Statement - Colorado Severance Tax Withheld from Oil Shale and OilGas Payments. The gift tax return is due on April 15th following the year in which the gift is made.

A self-addressed stamped envelope. A Colorado real estate power of attorney allows a principal to select an agent to handle one 1 or more real estate-related tasks on their behalf. Prior Year Real Estate Withholding Forms.

There is no inheritance tax or estate tax in Colorado. On November 3 2015 Colorado Springs voters approved a sales and use tax rate increase of 062 to fund road repair maintenance and improvements. B If notice is sent in a form that substantially complies with Section 53056 or 53252 the owner may withhold the funds immediately on receipt of the notice.

Counties and cities can charge an additional local sales tax of up to 71 for a maximum possible combined sales tax of 10.

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Tax Form Templates 5 Free Examples Fill Customize Download

10 Proof Of Income Documents Landlords Use To Verify Income

Real Estate Exam Cheat Sheet Real Estate Exam Real Estate Test Real Estate Business Plan

Understanding The 1065 Form Scalefactor

Tax Form Templates 5 Free Examples Fill Customize Download

Tax Form Templates 5 Free Examples Fill Customize Download

1977 Quebec Tax Form Partial Tax Forms Tax Partial

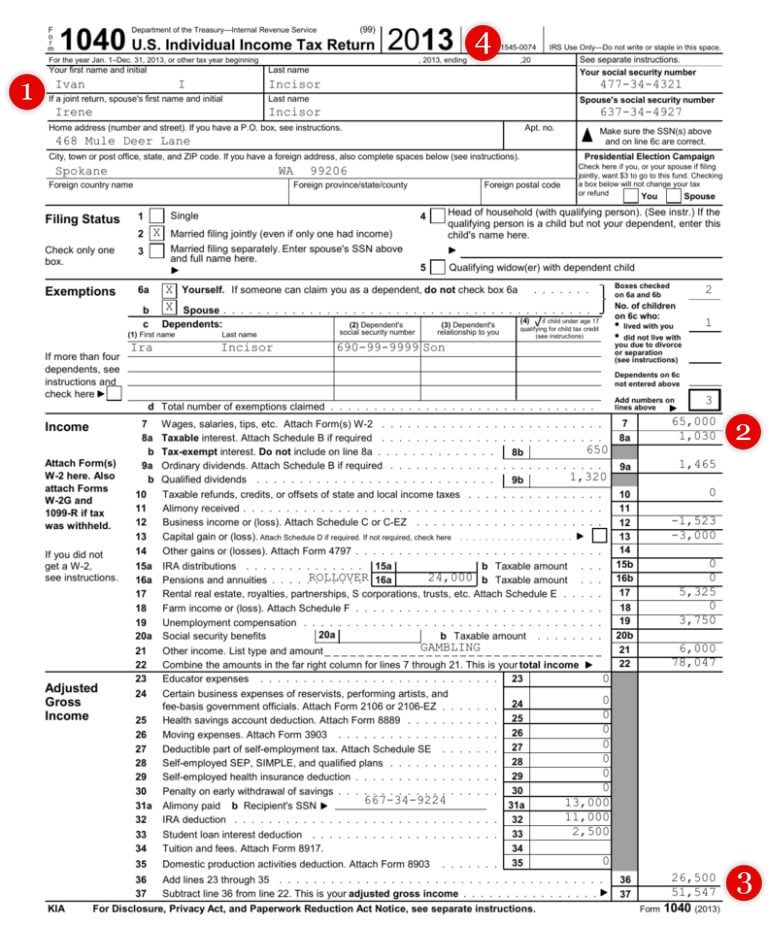

3 11 3 Individual Income Tax Returns Internal Revenue Service

How To File Taxes For Free In 2022 Money

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

:max_bytes(150000):strip_icc()/ScreenShot2022-01-24at10.05.23AM-cf89715f09964cbca096821b63196735.png)

Form 1099 K Payment Card And Third Party Transactions

How To Report Foreign Earned Income On Your Us Tax Return

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

:max_bytes(150000):strip_icc()/1040-NR2021-59bde80441114cfa9cb43d182e899b8b.jpeg)

Form 1040 Nr U S Nonresident Alien Income Tax Return Definition

Can You Deduct College Tuition On Your Federal Income Tax Return